Interchange Plus Pricing

What Is Interchange Plus Pricing?

Interchange plus is a method for pricing merchant services where the merchant pays a fixed processing fee over the exact cost of the card (the interchange rate).

All the rates and fees charged by the card brands and issuing banks are passed thru to the merchant at cost.

For this reason, it's also called cost plus or wholesale pricing.

Our Interchange Plus Pricing Plans

Burlington Bank Card has been specializing in interchange plus pricing since 2008.

Our pricing plans are extremely competitive, 100% transparent, and include 24/7 support with no contracts.

Choose any plan, there are no sales volume requirements.

| Interchange Plus | Monthly Service |

| 0.10% + $0.10 | $10.00 |

| 0.05% + $0.05 | $35.00 |

| 0% + $0.05 | $75.00 |

All plans include talech Mobile pos software. Additional payment solutions are available for purchase or rent. Reprogramming is free.

What's So Great About Interchange Plus?

For the vast majority of businesses interchange plus pricing is the least expensive and most transparent way to pay for credit card processing.

Since interchange is the same for all processors, the only fees up for grabs are the processing fees (basis points + per authorization + monthly fee), making it easier to make apples-to-apples comparisons.

Paying fixed processing fees over interchange vs a blended rate that includes interchange is almost always less expensive for the business. That's why most large businesses have interchange plus pricing and why it's referred to as "wholesale" pricing vs "retail" blended rates.

Payment Processing Solutions

Interchange plus is available on all our payment solutions, and on any payment application integrated to the Elavon network.

Talech mobile pos is included free with your account. You can add additional processing solutions like terminals, gateways, or pos.

Please see our Processing Solutions Price List at the bottom of this page for more details on all our processing solutions.

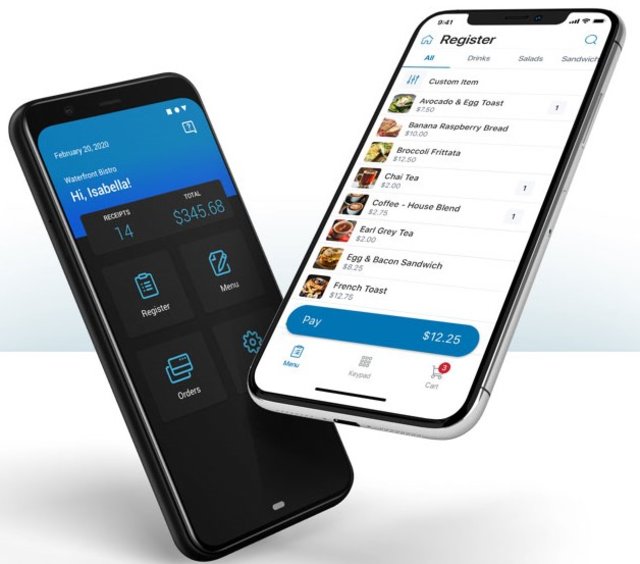

talech Mobile

The talech Mobile app is included free with your account, and gives you everything you need to run your business on the go.

- Process payments on your smart phone.

- Send e-invoices and collect online payments.

- Free with your account.

talech Terminal

talech Mobile POS on the Ingenico Axium smart terminal.

- Mobile POS software with a built-in card reader and printer.

- WiFi and 4G connectivity.

- Send e-invoices and collect online payments.

- Add to your account for $15 per month.

Text2Pay

Simple, secure transactions via text message.

- Request payment via message

- Pay via secure code

- Add to your account for $60 per month.

Terminals & Smart Terminals

Countertop and mobile credit card terminals and PIN Pads. New terminals start at $150.

- Ingenico

- PAX

- Poynt

- Rent starting at $10 per month.

E-commerce Payment Gateways

Authorize.Net

A leading payment gateway since 1996, and Visa-owned, Authorize.Net is one of the most trusted names in the payments industry.

- Integrations with over 100 shopping carts and e-commerce platforms.

- Purchase a new license or reprogram your existing gateway account.

Elavon Converge Payment Gateway

E-commerce, Mail Order / Phone Order, In-Store, and Mobile.

- Hosted payment page

- XML API

- Check.JS

- Buy button

- Virtual terminal

- E-invoicing

Network Merchants Inc

NMI is a leading global payment gateway for integrated solutions for card not present, card present, and e-commece.

- Trusted omni-channel integrated gateway solution.

- Purchase a new license or reprogram your existing account.

Point of Sale Systems

talech POS

- mobile

- retail

- restaurant

- services

- online ordering

- e-invoicing

- gift and e-gift cards

- Starting at $29 per month

Already have a payment solution that you want to reprogram?

Many payment solutions can connect directly to Elavon or via the Converge gateway.

Why Choose Burlington Bank Card?

Secure and reliable payment processing, excellent service, low fees and no contracts.

| What to look for? | Burlington Bank Card |

| Fees | Transparent interchange plus pricing or pass on the card fees with surcharging |

| Security | Registered elavon payments provider since 2008 |

| Compliance | Full-service pci compliance and 100% compliant surcharging |

| Support | 24/7 support and personal service |

| Payment Solutions | Innovative and user-friendly payments hardware and software for both in-person and online |

| Funding | Fast, reliable deposits in 1-2 days or same day |

| Contracts | No contracts no cancellation fees |

Choose Your Own Interchange Plus Pricing

Pick any plan you want. Change plans anytime. No contracts and no hidden fees.

| Interchange Plus | Monthly Service |

| 0.10% + $0.10 | $10.00 |

| 0.05% + $0.05 | $35.00 |

| 0.00% + $0.05 | $75.00 |